#LOGIN MINT INTUIT HOW TO#

I moved beyond budgeting to looking at other financial factors too, such as how to start investing, whether to contribute to a TFSA or RRSP and buying a house. After establishing my career and paying off my student loans, I didn’t need to live as frugally. I needed a more flexible tool to fit my family’s finances. One month, I might be making five figures, whereas another might bring $1000. It was exhausting, and for us, it wasn’t making a difference in our spending.īut the biggest reason for quitting ? My financial circumstances didn’t fit with this budgeting app.Īs a freelancer, my monthly earnings fluctuate from month to month and trying to stick to a set-in-stone budget just isn’t doable. So I’d have to correct mistakes and be extra diligent about reviewing the numbers. Sometimes got things wrong too, by misclassifying or duplicating transactions. I Just Outgrew įor one, I found the app rather time-consuming: I’d spend an hour a day scrutinizing every financial transaction. The app even sent reminders to pay my bills on time! But eventually, it wasn’t enough. It helped me make a budget (displayed in a colourful pie chart), track my cash flow, and monitor my credit score and savings.

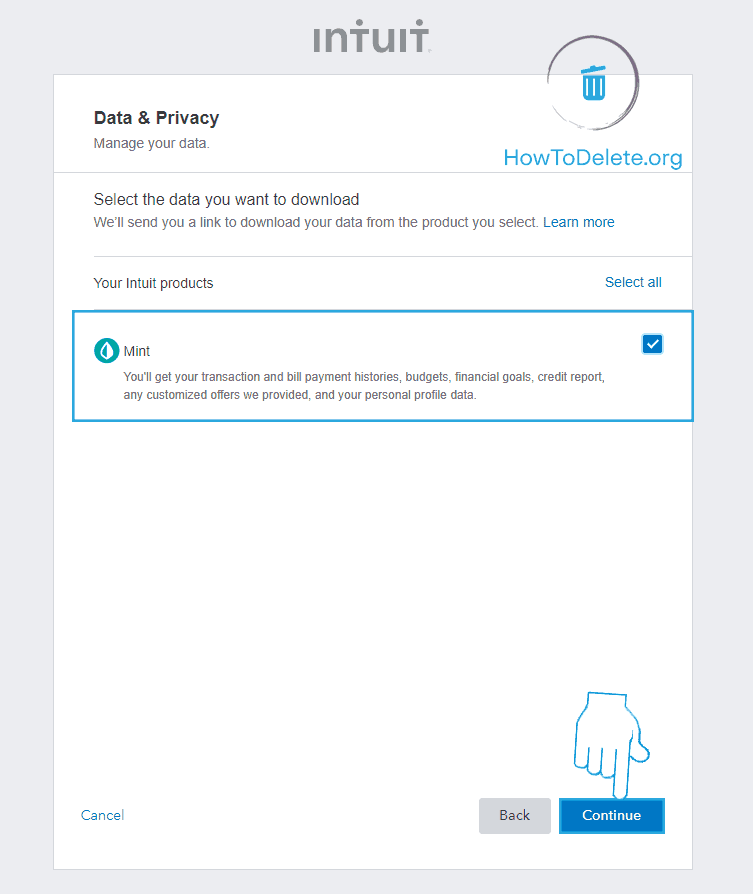

I managed my money from one dashboard, linking my bank accounts, mortgage, credit cards, PayPal, and savings accounts to the app.

#LOGIN MINT INTUIT FREE#

At first, gave me everything I needed: a free and simple budget tool that I could use on my computer or phone. This year, I broke up with my budgeting software.

Why I cancelled my account with, and what I did instead. For complete and current information on any advertiser product, please visit their Web site. We recommend you consult with a financial or tax advisor when making contributions to and distributions from an IRA plan account.Advertisers are not responsible for the contents of this site including any editorials or reviews that may appear on this site. Required minimum distribution, if applicable, is only relevant to this IRA plan and does not take into consideration other IRA plans held at American Express or other institutions. IRA distributions may be taxed and subject to penalties based on IRS guidelines. §IRA Contributions are subject to aggregate annual limits across all IRA plans held at American Express or other institutions. The first recurring deposit is assumed to begin in the second period after any initial deposit. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates. ♢Calculations are estimates of expected interest earned. See the Funds Availability section of your Deposit Account Agreement for more information. Funds deposited into your account may be subject to holds. Transfers can be initiated 24/7 via the website or phone, but any transfers initiated after 7:00 PM Eastern Time or on non-business days will begin processing on the next business day. ‡For purposes of transferring funds, business days are Monday through Friday, excluding holidays. **The national rate referenced is from the FDIC's published Monthly Rate Cap Information for Savings deposit products. Please see the Deposit Account Agreement for additional terms and conditions and Truth-in-Savings disclosures.

Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. After a CD is opened, additional deposits to the account are not permitted. The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after completing your account-opening deposit. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. The rate received will either be (i) the rate reflected during your application process or (ii) the rate being offered when your CD is funded, whichever is higher. Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is opened.įor a CD account, rates are subject to change at any time without notice before the account is funded. *The Annual Percentage Yield (APY) as advertised is accurate as of.

0 kommentar(er)

0 kommentar(er)